Our Tax Strategy

We can help you permanently reduce your taxes by as much as 40% or more.

Discover Your Goals

We will help you reach your financial dreams faster. We'll show you how to permanently reduce your taxes, and it will give you a new way to think about your financial future.

Carve Your Path

We'll help you get clear on your financial goals and build a plan that will help you get there much, much faster. You’ll be lowering your taxes, protecting your assets, and setting your business and investments up for long-term success.

Get There Faster

This is where the rubber meets the road. This is where you start building wealth to reach your dreams. The best part? With our system, you’ll go to sleep at night knowing you are paying the least amount of tax, building wealth faster, AND playing within the rules.

FREE Tax Assessment

Don't miss this... Reserve Your Spot Now To Access A Free Tax Assessment and Save Thousands.

Schedule a CallChances are, you’ve heard of a tax strategy, but you don’t know where to start. Just thinking about taxes might even make you nervous. Tax strategies have one over-riding objective: to increase your wealth.

As a business owner or investor, your focus is on growth. That’s where it should be. Your work is your passion, and no one is as invested in your growth as you. You want to become wealthy, secure, and financially independent.

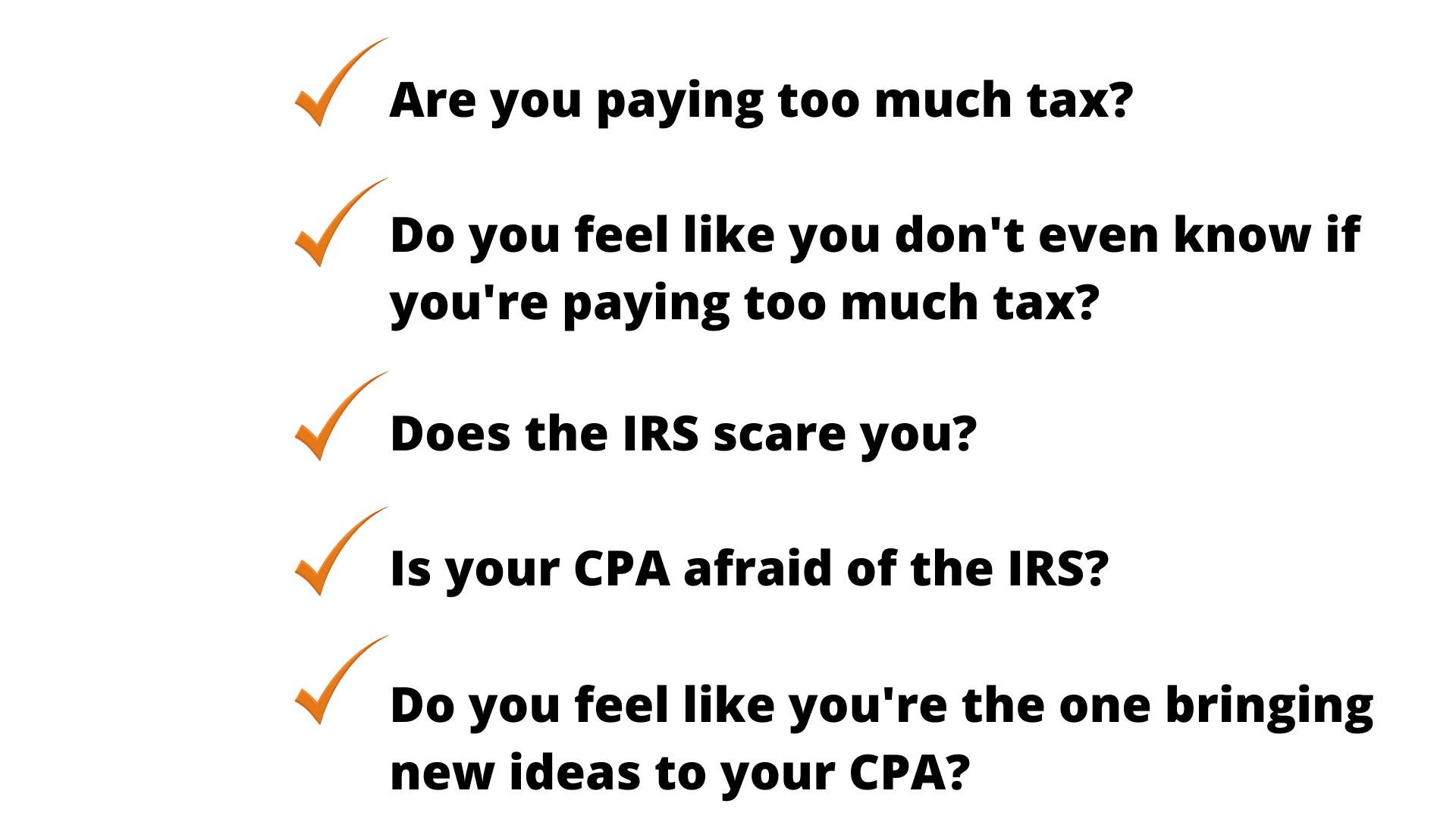

Taxes aren’t at the top of your mind unless it’s time to pay them. If you’re like most business owners and investors, you sometimes feel like taxes are beyond your control. This makes you worry that you’re doing the wrong thing, trusting the wrong person, or wasting a lot of money.

WHAT IS A TAX STRATEGY?

A tax strategy is a plan of action for reducing taxes, regardless of your business or investment situation. It is more than just wishing you could pay fewer taxes. It is a strategy crafted to ethically and morally ensure you pay the least amount of tax allowable by law.

A tax strategy optimizes the way your business income and personal spending is structured. It includes an analysis of how your business structure affects your payroll and income taxes, which of your expenses are deductible, and how you can most efficiently support the people and causes important to you. It will detail how you can reduce your taxes based on current tax law by maximizing your deductions based on your wealth strategy, shift income from high tax rates to lower tax rates, and maximize your tax credits.

Tax strategies are different from typical practices of CPAs. A tax strategy is a long-term vision for your financial and business future. That’s why your tax strategy should be designed for years, if not decades, ahead.

WHY DO YOU NEED A TAX STRATEGY?

Like every aspect of your business, your tax situation improves when you take a strategic approach. An effective tax strategy can help you shift from having taxes as one of your biggest expenses to having your taxes be one of your biggest assets. After all, every dollar you save in taxes can be reinvested in your business, real estate, stocks, or other investments.

The process of creating a tax strategy forces you to get clear about where you are financially today and where you want to be in the future. It also equips you with the techniques you can use to accelerate your progress. You’ll set up your business entities and investments in ways that best serve your goals. And you’ll save money by thinking of deductions as guidance rather than pitfalls to be avoided.

Your tax strategy should evolve over time, alongside your business and investments. It should also adjust in line with tax laws, ensuring that you are continually paying the least amount of tax allowable.

Finally, remember that your tax strategy is there to serve you and your financial goals, not to confuse or overwhelm you. A professional tax strategist at AMZ Accounting can guide you through the process so that you can feel confident in your plans and decisions.